One of the most important determinants of the plaintiff’s future earnings is the rate at which those earnings will grow. There are two broad determinants of this rate. First, each individual benefits from increases that arise from gains in experience, promotions, and job changes. Second, as the economy grows, the earnings of all individuals rise with it – the source of the popular aphorism “a rising tide lifts all boats.” The purpose of this article is to summarise the most recent research concerning the latter rate, which economists call the real rate of growth of earnings, and which the courts often refer to as the productivity factor.

We divide our discussion into three parts: In the first, we define what we mean by real rate of growth of earnings. In the second, we provide two types of statistical evidence concerning that rate. Finally, we argue that the most reliable projections of that rate are obtained from agencies that specialise in making such projections. We conclude that those projections indicate that real earnings will grow at approximately 1.25 to 1.50 percent per year in the long run.

1. Definition: Real rate of growth of earnings

Assume that it has been observed that economy-wide earnings have increased at five percent per year. This “observed” rate is referred to as the nominal rate of growth of earnings. Economists divide this rate into two factors: those due to increases in the average level of prices, the rate of price inflation, and those due to increases in the purchasing power of wages, the real rate of growth of earnings.

For example, if the rate of price inflation has been two percent per year, the first two percent of a five percent nominal increase will be needed just to allow individuals to buy the same set of goods that they had been able to purchase before the price increase. The remaining approximately three percent will be available to purchase additional goods. That three percent is called the real rate of growth of earnings.

As there is a strong consensus in the financial community that the long-run rate of price inflation will be approximately two percent, the forecast of wage growth can focus on the real rate of growth. [The financial community widely believes that the rate of inflation will be two percent because (a) that is the rate that the Bank of Canada has targeted since 1996; and (b) the Bank has managed to maintain the actual rate of inflation near its target since the latter was introduced.]

2. Methods of predicting the real rate of growth of earnings

In the long run, if workers are to be able to purchase more goods with their earnings (that is, if real wages are to rise), they must produce more goods. Hence, it is commonly argued that long-run increases in average real earnings must approximate long-run increases in average output per worker. As the latter is often called the rate of growth of productivity, the terms “real rate of growth of earnings” and “rate of growth of productivity” are often used interchangeably in the courts. Although this conflation could be misleading in the short run, when deviations between the two are common, if we are concerned with lifetime changes in a plaintiff’s earnings, projections of productivity growth can substitute for projections of real wage growth.

In this section, we provide two types of data concerning the growth of both real earnings and productivity. In the first, projections assume that past growth rates will continue into the future. In the second, models of the growth of the economy are used to derive predictions concerning growth of wages and productivity.

2.1 Historical data

In Table 1, we compare Alberta wage and price inflation, from 2001/2002 through 2017/2018. It is seen from this table that over the 2012-2018 time frame, which coincided with a considerable economic downturn in the Alberta economy (2014-2016), price inflation was higher than wage inflation. However, a longer-term perspective finds that wage inflation averaged approximately 0.78 percent higher than price inflation over the ten-year period 2008-2018; and approximately 1.0 percent higher than price inflation over the seventeen-year period 2001-2018.

If it is assumed that the experience of the last two decades or so is indicative of what will happen in the next few decades, then the data in Table 1 suggest that the real rate of growth of wages will be approximately 1.0 percent per year.

The data reported in Table 2, obtained from Statistics Canada, suggest that Canadian labour productivity has increased at an average annual rate of approximately 1.23 percent over the past 37 years (from 1982 through 2018), and 0.88 percent over the last five years (2014-2018).

Again, a forecast of 1.0 to 1.25 percent seems to be supported by the data.

2.2 Forecasting Agencies

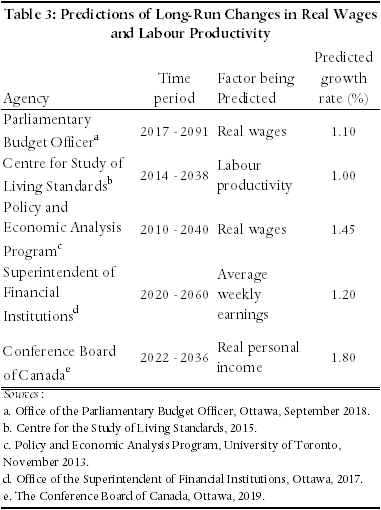

We have identified five reputable, independent agencies that provide public projections of either real wages or labour productivity. We summarise their long-run projections in Table 3, below.

Table 3 suggests that reputable forecasting agencies are predicting that real wages will grow at approximately 1.25 to 1.50 percent per year over the next two or three decades.

3. Selecting a forecast

Our experience is that most financial experts have relied on historical figures, such as those we reported in Tables 1 and 2, to project the rate of growth of real wages/productivity. For two reasons, we caution against acceptance of this approach.

First, there is no theoretical basis for assuming that what has happened in the past will continue into the future. For example, advances in computer technology are introducing changes to the economy that may differ in significant ways from those that have occurred in the past; the wave of “baby boomers” is about to retire from the labour force; and interest rates have fallen to historical lows.

Second, with very few exceptions, the financial experts who testify in personal injury cases have not devoted significant amounts of time to the analysis of long-run changes in labour productivity. Given a choice between the testimony of individuals whose primary expertise is in the preparation of personal injury reports and that of individuals who devote their professional lives to the forecasting of long-term trends in the economy, it seems to us clear that it is the latter that should be preferred.

Accordingly, we recommend that the courts rely on the forecasts of the five agencies identified in Table 3, and on others with similar expertise, when determining the “productivity factor” to be employed in personal injury and fatal accident actions.