When a spouse has been killed through the negligence of a third party, the surviving spouse is entitled to damages that would allow him/her to maintain the standard of living that he/she had previously enjoyed.

The determination of this value requires that three steps be taken. First, the potential earning capacity of each spouse must be estimated. Second, a calculation must be made of each spouse’s dependency rate – that is, the percentage of family income that benefitted that spouse. Third, it must be determined whether any monies that had been spent on the deceased by the survivor (and which now do not have to be spent due to the death of the former) should be deducted from the survivor’s loss of dependency. In what is known as the sole dependency approach, that “saving” is not deducted. In the cross dependency approach, the saving is deducted.

In this article, I will use a concept that is fundamental to economic analysis – the rational person assumption – to suggest that basic economic principles favour the use of sole dependency.

I begin by making some simple assumptions about a couples’ earning capacity and dependency rates and use those assumptions to define sole and cross dependency. I then introduce the rational person assumption and provide examples of the use of that assumption in non-fatal accident cases. Finally, I extend the analysis to fatal accident cases and argue the rational person assumption provides support for use of the sole dependency approach.

Assumptions concerning earning capacity and dependency

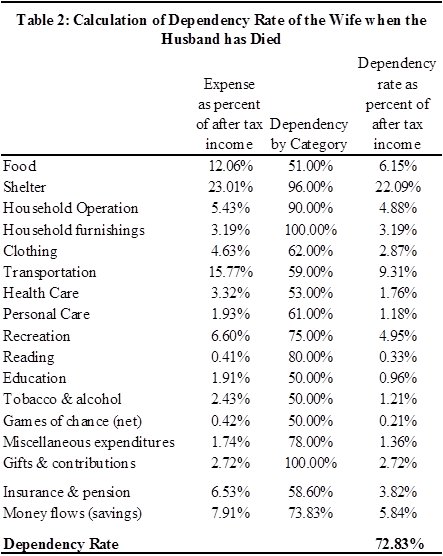

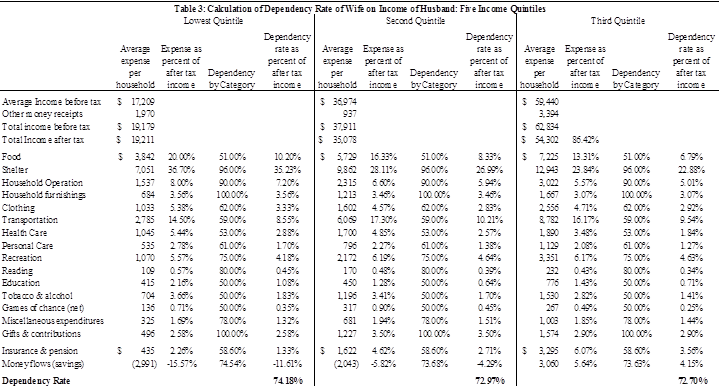

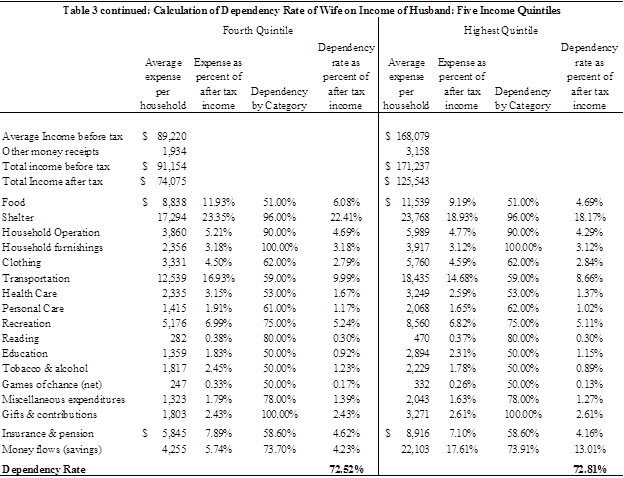

Statistical analyses suggest that, in a household consisting of a husband and wife, approximately 30 percent of the family’s after-tax income is spent on items such as food, clothing, and transportation that benefit the husband alone; approximately 30 percent is spent on items that benefit the wife alone; and 40 percent is spent on items, such as housing, furniture, and insurance, that benefit both spouses collectively. Each spouse benefits, in total, from 70 percent of family income – 30 percent that benefits that spouse personally – usually referred to as “personal expenses” – and 40 percent that benefits both spouses equally – “common expenses.” The 70 percent figure in this example is known as the individual spouse’s “dependency rate.” [Note that, as both spouses have the same dependency rate, 70 percent, there is a net benefit from marriage.]

Assume that in a childless couple, the husband earns $100,000 per year after taxes and the wife earns $40,000. Based on my assumptions concerning dependency rates, out of the husband’s income, 30 percent, or $30,000, is devoted to his personal expenses, 30 percent, or $30,000, is devoted to his wife’s personal expenses, and 40 percent, or $40,000, to common expenses. From the wife’s income, the comparable figures are 30 percent ($12,000), 30 percent ($12,000), and 40 percent ($16,000), respectively.

Cross and sole dependency defined

Now, assume that the wife has been killed. The sole dependency approach asks: how much of the wife’s future income would have been devoted to expenses that benefitted the husband? The answer in this case is that it is the 30 percent of her income that she spent on items specific to her husband (food, clothing, etc.) plus the 40 percent of her income that she spent on common expenses (housing, furniture, etc.), or $28,000 – which equals the husband’s dependency rate, 70 percent, multiplied by the wife’s (after-tax) income, $40,000. The tortfeasor would be required to pay $28,000 per year until the projected date of the wife’s retirement, discounted to the present.

Proponents of the cross dependency would also calculate the husband’s dependency on the wife’s income, here $28,000. But they would then argue that there is an offset against that loss: the “savings” obtained by the husband because he no longer devotes 30 percent of his income to his wife’s personal expenses. In the example here, as the husband was spending 30 percent of his income on his wife, it is argued that he now benefits from a $30,000 saving as a result of her death. The difference between this $30,000 saving and the $28,000 he has lost, $2,000 per year in total, represents a net benefit to him. He has no claim (for dependency loss) against the tortfeasor.

The “Rational Person” assumption

Which of these approaches is more consistent with the legal principal that plaintiffs are to be returned to the position they would have been in had the negligent action not occurred, restitutio in integrum?

When answering this question, economists rely on an assumption that is fundamental to economic analysis: that individuals act rationally to improve their own welfare. This rational person assumption implies that informed individuals will voluntarily undertake actions only if those actions make them better off (or, at least, no worse off). [Note the similarity to the “reasonable person” doctrine of tort law and to the rationale, in contract law, for maintaining the sanctity of contracts.]

As a simple example of the rational person assumption, assume that individual B is observed to be saving towards the purchase of a lap-top computer. One day, B sees an ad for the computer he likes, at a price of $1,000 (inclusive of all taxes). He checks his bank balance and discovers that he has $1,500. Assume we also observe him use his debit card to buy the desired computer; and, when he gets home, to check his bank balance again, to find that he now has $500.

Can we, as an external observer (with no ability to read B’s mind) conclude that B is “better off?” Economists, employing the “rational person” assumption, argue that B must be better off than if the purchase had not been made: a rational individual will only pay $1,000 for an item if he or she values that item at more than (or equal to) $1,000.

Although it might be argued that B is “worse off” in the sense that he now has $1,000 less than he would have had, that reduction in his finances is at least offset by the fact that he now has a computer that he valued at $1,000 or more.

To put it another way, if an individual was observed to go shopping with the intention of paying $1,000 for a computer, but was prevented from doing so because the store had run out of stock, no professional economist would argue that that individual was now “better off” — because he now has $1,000 that he would otherwise not have had. He is not better off. His preference was observed to be to trade the $1,000 for a computer – that would have made him better off. [Indeed, the rational person assumption suggests that when he is prevented from spending his money the way that he prefers, he is made worse off.]

The Rational Person argument applied to personal injury cases

Before examining how this view of rational behaviour applies to fatal accident cases involving spouses, I first turn to two other classes of tort actions.

In the first of these actions, assume that an individual has been seriously injured in a motor vehicle accident. As a result of this accident, her earning capacity has been impaired to the extent that she will lose $100,000 between now and the time she would have retired. The defendant accepts responsibility for this loss, but counters that offset against this loss is a “gain” that the plaintiff has obtained because of the accident. Imagine that before the plaintiff was injured, she was an active golfer, spending $5,000 a year on green fees, lessons, and equipment. The injuries suffered in the accident, however, are such that she can no longer play golf, thereby “saving” $5,000 per year. Assume also that evidence has been led to suggest that she would have played golf for another 25 years, had she not been injured. Hence, because of her injuries, she will save approximately $125,000 over her lifetime that would otherwise have been spent on golf. The defendant argues that when this saving is deducted from the plaintiff’s lost earnings, the plaintiff is actually $25,000 better off as a result of the accident. The defendant owes nothing to the plaintiff.

Using the assumption of the rational individual, however, it is easily seen why the defendant’s argument in this case is fallacious. Although it is true that the plaintiff will now have $125,000 available to her that she would not have had in the absence of the accident, she now has been denied $125,000 worth of pleasure that golf would have given her. Ignoring the effect of the accident on her earnings, in order for the plaintiff to be left in the same position she would have been in the absence of the accident, she will have to spend sufficient money to replace the value she would have obtained from golf. But this must be at least $125,000: because she would have chosen to spend $5,000 per year on golf in preference to spending it on anything else, $5,000 spent on “anything else” must be of lesser value than that expenditure on golf. That the plaintiff now has $125,000 that she would not have had if she had been allowed to spend it on golf does not make her $125,000 better off. At best, it leaves her in approximately the same position as she would have been in had she been allowed to spend that money. Hence, it is incorrect to suggest that the $125,000 that has been “saved” should be set off against the plaintiff’s loss of earnings.

In the second example of a tort action, assume again that the injuries suffered by the plaintiff in an automobile accident have reduced his lifetime earnings by $100,000. Again, the defendant has accepted responsibility for the accident; but in this case, she argues that as the plaintiff’s daughter was killed in that accident, the plaintiff has been “saved” the costs of raising that child. If those costs have been calculated to be $150,000 over the life expectancy of the child, the defendant argues that the net effect of the accident has been to leave the plaintiff no worse off than he had been in the absence of the accident. There is no loss.

Again, the fallacy of this argument arises because the defendant has implicitly argued that the plaintiff would not have received any benefit from the $150,000 he would have spent on his daughter. But, according to the “rational consumer” assumption, if the plaintiff had chosen to have the daughter and to spend $150,000 on her, in preference to spending that money in any other way, the plaintiff is worse off having $150,000 than he would have been spending that money on his daughter.

The Rational Person argument applied to fatal accident cases

With these cases in mind, consider again the case discussed at the beginning of this article, concerning the death of a wife. It is now seen that when the defendant argues that the cross dependency approach should be applied, what he is actually arguing is that the $30,000 the plaintiff had been spending on his wife had provided him with no benefit at all. Now that those expenditures have been “freed up”, he can spend the money on himself, at a net gain of $30,000. Therefore, the defendant argues that that gain can be set against other losses from the accident – as was argued by the defendants in the cases of the plaintiffs who were asked to set their savings of expenditures on golf or on their child against their losses of income.

But, as in those cases, the rational person assumption suggests that surviving spouses are not better off when they do not “have to” make expenditures on their deceased partners. If they were making those expenditures voluntarily (i.e. rationally), they must have obtained some benefit from that expenditure – indeed, a benefit that exceeded the value from any other purchases that could have been made with the same amount of money. Now that the husband in the example does not “have to” spend $30,000 per year on his wife, he can spend it on himself – clothes, travel, cars, etc. But does that expenditure give him as much pleasure as spending it on his wife? The better argument, I suggest, is that preventing plaintiffs from spending money in the way that they would have chosen cannot make them better off. Hence, it would be inappropriate to deduct any such purported “gains” from plaintiffs ‘other losses.

It is the sole dependency approach that is more consistent with both restitutio in integrum and with the rational person assumption.

Summary

A fundamental assumption in economics is that individuals are rational; and, therefore, that when an individual is observed to make a voluntary choice, it can be concluded that the individual must have expected that choice to make him/her better off (or, at least, no worse off). With respect to fatal accident actions, this implies that if spouses are rational, they must have expected that the decisions they made about spending on one another would make them better off. In this article, I have argued that if this proposition is accepted, the sole dependency approach is preferred to cross dependency.

Christopher Bruce is the President of Economica and a Professor of Economics at the University of Calgary. He is also the author of Assessment of Personal Injury Damages (Butterworths, 2004).